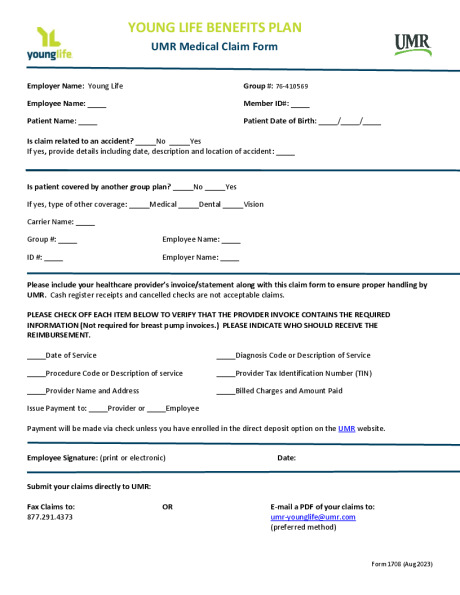

Medical

Young Life offers eligible employees two medical plan options through UMR which utilizes the United Healthcare Choice Plus network of providers. All monthly premium costs for both plans are paid for by Young Life and billed to your mission unit. You can maximize coverage by utilizing in-network providers.

Medical Plan Comparison

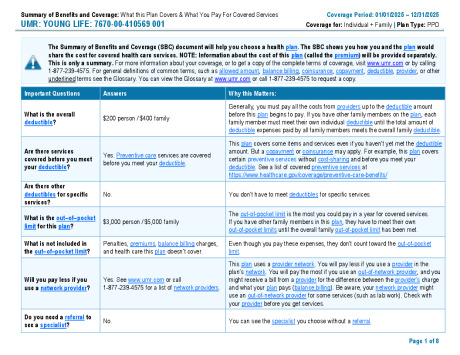

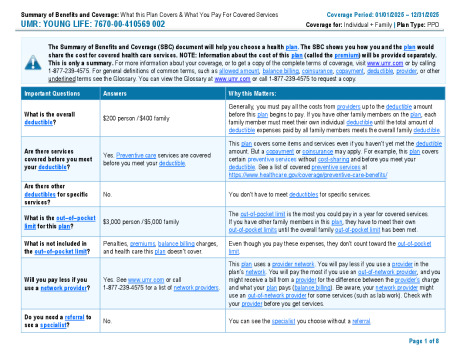

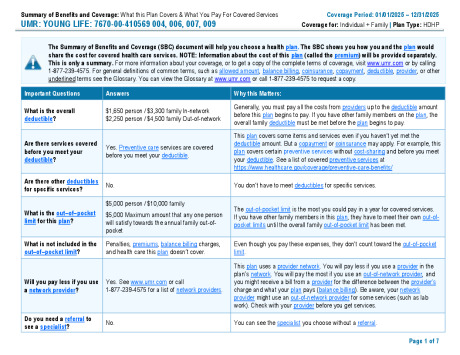

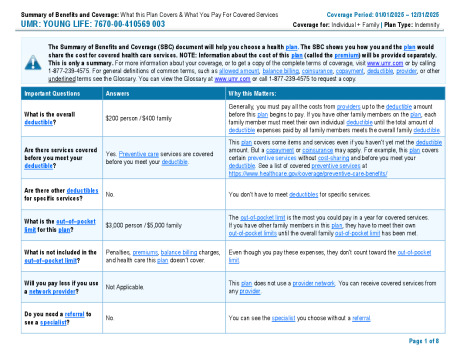

| col1 | col2 | col3 | col4 | col5 | ||||

|---|---|---|---|---|---|---|---|---|

| PPO/Non-PPO Medical Benefits 90/70 Plan |

PPO/Non-PPO Medical Benefits 80/50 (HDHP) Plan |

|||||||

| In-Network | Out-of-Network | In-Network | Out-of-Network | |||||

| Calendar Year Deductible | **Deductible combined for in and out-of-network services | **Deductibles accrue separately for in and out-of-network services | ||||||

| Individual Family |

$200 $400 |

$200 $400 |

$1,650 $3,300 |

$2,250 $4,500 | ||||

| Coinsurance | 90% after deductible | 70% after deductible | 80% after deductible | 50% after deductible | ||||

|

Out of Pocket Max (includes deductible and coinsurance only) Individual Family |

$3,000 $5,000 |

$3,000 $5,000 |

$5,000 $10,000 |

$5,000 $10,000 | ||||

| Preventive Care for Adults and Children | 100% covered | 70% covered | 100% covered | 50% covered | ||||

|

Doctor's Office visits Primary Specialist |

90% after deductible 90% after deductible |

70% after deductible 70% after deductible |

80% after deductible 80% after deductible |

50% after deductible 50% after deductible | ||||

|

Hospitalization Inpatient Outpatient (Surgery) |

90% after deductible 90% after deductible |

70% after deductible 70% after deductible |

80% after deductible 80% after deductible |

50% after deductible 50% after deductible | ||||

| Mental Health | 90% after deductible | 70% after deductible | 80% after deductible | 50% after deductible | ||||

|

Counseling (Marriage, Family & Individual) |

100% up to $4,000 each calendar year per family | 100% up to $4,000 each calendar year per family (subject to in-network deductible) |

||||||

|

Pregnancy & Maternity Routine Prenatal Care Non-Routine Prenatal, Delivery & Postnatal Care |

100% 90% after deductible |

70% after deductible 70% after deductible |

100% 80% after deductible |

50% after deductible 50% after deductible | ||||

| Emergency Room/ Emergency Physicians |

90% after deductible | 90% after deductible | 80% after deductible | 80% after deductible | ||||

| Urgent Care Center | 90% after deductible | 90% after deductible | 80% after deductible | 80% after deductible | ||||

| Teladoc | 90% after deductible | 90% after deductible | 80% after deductible | 80% after deductible | ||||

|

Pharmacy 30 Day Retail Supply Generic Preferred Brand Non Preferred Brand Specialty 90 Day Mail Order (Excludes Specialty Drugs) |

$7 copay (no deductible) $25 copay (no deductible) $50 copay (no deductible) $ 100 copay (no deductible) $14/$50/$100 |

$7 copay (after deductible) $25 copay (after deductible) $50 copay (after deductible) $100 copay (after deductible) $14/$50/$100 |

||||||

| Deductibles reset every January 1st | ||||||||

Note: Although every effort has been made to ensure accuracy errors may occur. Please see the UMR SPD for complete list of benefits and exclusions. The content of this chart is for informational purposes only. If there is any conflict between the information in this chart and the official plan document, the official plan document will govern.

Preventive Care

On both medical plans, preventive care is covered at 100% in network with no employee cost share. We encourage you to establish a relationship with a primary care provider (PCP), and take advantage of preventive care services and screenings available through the plan. You can find more details about these services and look for a doctor in your area by logging into the UMR member portal. You may also set up a virtual PCP visit by accessing the care available through Teladoc Primary360 (more details on the telemedicine page).

Pre-Authorization Note

Please note that some services, including non-emergency hospital stays, transplants and chemotherapy must be pre-authorized. Contact the UMR Care number on your ID card for more information.

Emergency Room vs. Urgent Care

When possible, choosing an urgent care facility over an emergency room will save you money. When you have a life- threatening situation, such as chest pain, or a sudden and severe pain, the emergency department of the nearest hospital may be the only option. If your condition is less serious, but still requires immediate attention, choosing an urgent care facility can save you significant time and money. For example, if you have a sprained ankle or an ear infection, you may end up waiting for many hours in the emergency room and paying hundreds of dollars. Most urgent care centers are open for extended hours, and will be able to accommodate you more quickly than an emergency room. If you have any questions about the care you should seek, contact your doctor or the Nurseline listed on the back of your ID card.