Voluntary Coverages

The following plans are voluntary and paid by the employee, meaning you decide whether or not you’d like to enroll in the plan.

Optional Term Life and AD&D Coverage

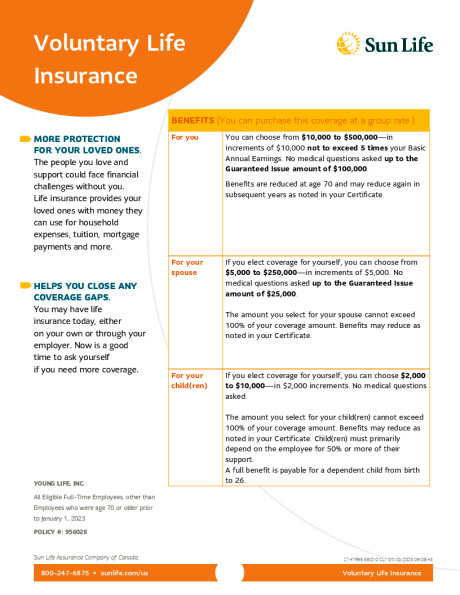

You may purchase additional, optional term life and accident coverage through SunLife through payroll deductions on an after tax basis. Term Life insurance does not accrue a cash value. You elect life and accident coverage separately. Coverage in this policy may be subject to evidence of insurability (EOI).

Life Coverage

- For you: You may elect up to the lesser up 5 x your annual salary or $500,000 in increments of $10,000. Coverage for newly-eligible employees is guaranteed up to $100,000. Any election over the guaranteed issue amount is subject to Evidence of Insurability (EOI). All elections for late enrollees are subject to EOI. Any election beyond the guaranteed issue amount will not be considered until after a completed EOI is promptly submitted. Age reductions start at age 70.

- For your spouse*: You may elect coverage in increments of $5,000 up to the lesser of $250,000 or 100% of the optional life coverage you elected. Spouse coverage for newly-eligible employees is guaranteed up to $25,000. Any election over the guaranteed issue amount is subject to EOI. All elections for late enrollees are subject to EOI. Any election beyond the guaranteed issue amount will not be considered until after a completed EOI is promptly submitted. Age reductions start at age 70.

- For your child*: Employees may elect increments of $2,000 up to $10,000. Premiums are calculated per unit of coverage, meaning that the payroll deductions will remain the same regardless of the number of children covered by the plan. Dependent children may be covered to age of 26.

*In order to elect Optional Spouse or Child Life, you must elect Voluntary Life for yourself.

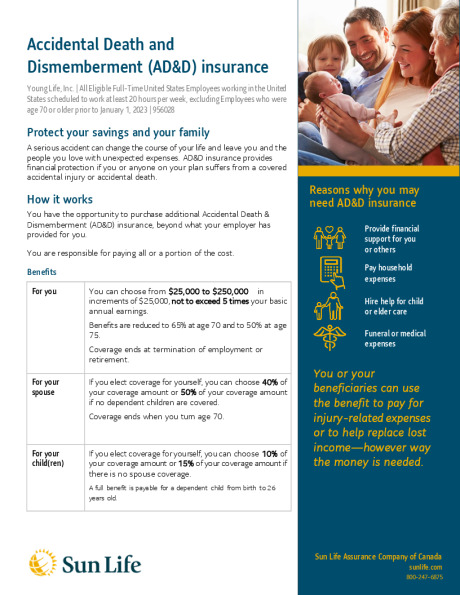

Optional AD&D:

- For you: You may elect up to $250,000 in increments of $25,000.

- For your spouse and your children: Your spouse’s benefit will be 40% of your elected benefit up to $100,000, and each of your covered children will be eligible for 10% of your benefit up to $25,000.

- For your spouse: Your spouse will be eligible for 50% of your benefit up to $125,000.

- For just your children: Each of your covered children will be eligible for 15% of your benefit up to $37,500.

Supplemental Health Plans

Three supplemental health plan options are available to you for purchase. Premiums are deducted via payroll deductions on an after-tax basis. These benefits are not available to international staff.

Supplemental health benefits, which were formerly provided by Aflac, will now be offered through United Healthcare (UHC).

With UHC, these benefits are integrated with your Young Life UMR medical plan (if enrolled). In many cases, eligible claims for covered illnesses, accidents, and hospitalizations trigger eligible reimbursements to be paid to you automatically, helping you get the most out of your benefits. In all cases, the benefits provided by these supplemental health plans are in addition to the benefits provided by your UMR health plan.

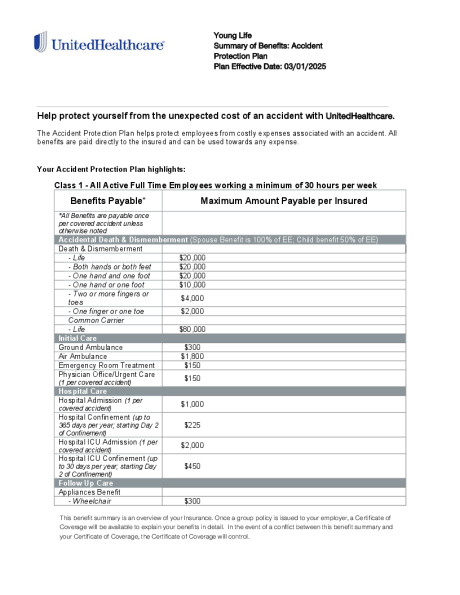

Accident

The Accident protection plan is built to provide a financial cushion for unforeseen costs following an unexpected injury. When you submit an eligible claim, the Accident Protection Plan pays a cash benefit directly to you, in addition to the benefits provided by your health plan. You don’t have to meet a deductible to receive this benefit. The date of accidental injury must occur on or after the coverage effective date. The policy covers over 80 injuries and services, including: Ambulance services, burns, concussions, ER and urgent care visits, fractures / dislocations, lacerations, organized sports injuries, and much more. Dependent spouses and children are also eligible if you elect coverage for yourself.

Accident Insurance

Hospital Indemnity

The Hospital Indemnity plan is designed to help offset the financial impact if you’re admitted to the hospital. With an eligible claim, the Hospital Indemnity plan pays a cash benefit directly to you — and you can use the money any way you want. The payment you’ll get is in addition to the other benefits your health plan may provide. The plan provides benefits for eligible hospital and ICU admissions and confinements, including those related to pregnancy. Dependent spouses and children are also eligible if you elect coverage for yourself.

Hospital Indemnity Coverage

Below is a required disclaimer for the Hospital Indemnity plan:

IMPORTANT: The Hospital Indemnity Supplemental Health plan described in this guide is a fixed indemnity policy, NOT health insurance.

This fixed indemnity policy may pay you a limited dollar amount if you’re sick or hospitalized. You’re still responsible for paying the cost of your care.

- The payment you get isn’t based on the size of your medical bill.

- There might be a limit on how much this policy will pay each year.

- This policy isn’t a substitute for comprehensive health insurance.

- Since this policy isn’t health insurance, it doesn’t have to include most federal consumer protections that apply to health insurance.

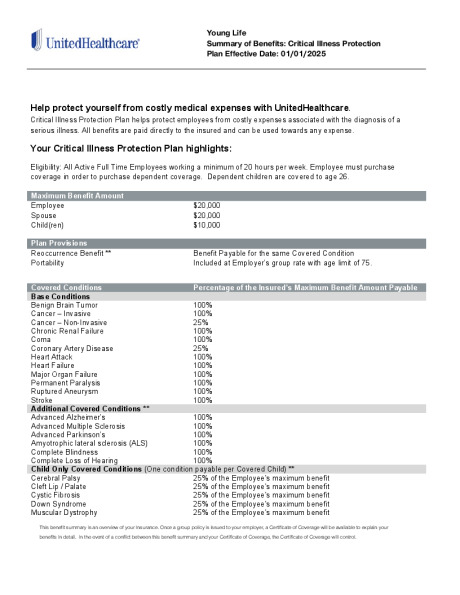

Critical Illness

The Critical Illness plan is designed to provide a financial cushion to help cover unforeseen costs if you become seriously ill. Upon diagnosis of a covered condition, the Critical Illness plan pays a cash benefit directly to you — in addition to the benefits already provided by your health plan. Conditions that may qualify for a benefit payment include: Heart attack, stroke, cancer, chronic renal failure, ruptured aneurysm, coronary artery disease and more. If you experience a covered condition, the maximum benefit amount is $20,000. If you elect coverage for yourself, you can also cover your spouse ($20,000 max benefit amount) and dependent children ($10,000 max benefit amount).

Critical Illness Insurance

Voluntary Short-Term Disability Insurance

This policy, provided by Aflac, covers you in the event you cannot work due to an illness or an accident by providing protection for your income for up to 6 months. If you elect this benefit after you are initially eligible, you will need to be approved by Aflac. The minimum benefit is $300 and the maximum is $3,000 per month. Only employees are eligible to enroll in this benefit.

Short-Term Disability (STD)

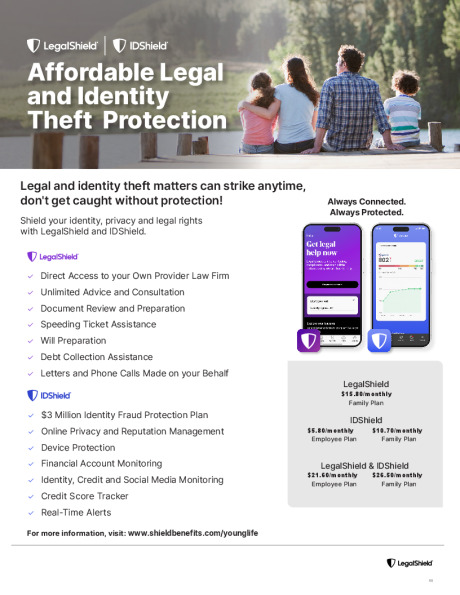

ID Theft Protection / Legal Shield

You may purchase identity theft protection and/or pre-paid legal services for you and your immediate family members through convenient payroll deductions. Monthly subscription prices are as follows:

- Legal Shield: $15.80 per month (individual + family)

- ID Shield: $5.80 for individuals, $10.70 for families.

- Legal Shield and ID Shield: $21.60 for individuals, $26.50 for families.

Note: This benefit is not available to international employees..

The Legal Shield membership includes: personal legal advice, letters/calls made on your behalf, contract and document review, will and living trust preparation, assistance with moving traffic violations and IRS audits, adoptions and other valuable services.

The ID Shield membership includes: privacy and security monitoring, full-service identity restoration, consultations and other valuable services.

For more information, please access the Legal Shield page on Staff Resources or the www.younglifebenefits.com portal or app.